Financial blogs have been discussing one of the core technical indicators I use everyday in evaluating stocks and ETFs: RSI(2).

VIX and More called attention to MarketSci Blog and his analysis of RSI(2) here, here, and here.

If you have no clue what RSI is, you can dig through some older Pig posts for an explanation, or just read the first MarketSci Blog post and follow his links.

After reading these posts and their comments, I found this analysis at Skill Analytics that shows the 2-period RSI tool is better than extending the RSI reading out to three, four, or the standard fourteen-day-period. Here's an excerpt:

On a recent post on Marketsci on the use of RSI2, Bill Luby of VIX and More posted the following comment:

Count me among the fans of RSI (2). I think you might get more interesting results — though with much more time out of the market — using 95/5 and 98/2 as break points.

Also, if everyone is jumping on the RSI (2) bandwagon, perhaps it is time to spend more time evaluating RSI (3) or RSI (4) strategies. Just a thought.

Nice work, as always, but why do I always feel like I am assigning homework when I comment here…?

Well, I agree Bill - you can't keep assigning homework to poor Michael. I mean, where is the rest of the collective quantitative testing blogosphere when you need it? Michael's doing all the heavy lifting! So to help Mike out, I've done some testing on different RSI days to see what would happen. I can't promise the snazy charts of Mike's blog, but I'll just break it down here quickly.

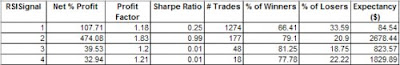

I created a basic system that buys the SP-500 when the RSI(N numbered day) goes below 10 and sells when it goes above 90. You could do a further optimization of the actual buy and sell levels - I haven't bothered to do that here. I next optimized the system by having it run through different N numbered days. So, RSI(1), RSI(2), RSI(3), etc. Here's the results:

So, as you can see, RSI(2) seems to do a lot better across a number of metrics. These include Expectancy, Sharpe and a few others.

I agree with Bill Luby's assertion that the more extreme RSI(2) readings of 95/5 or 98/2 provide better trading results. And then I remembered where I had learned this, on the Trade While Working blog.

In the November issue of Technical Analysis of Stocks and Commodities, an article by Larry Connors and Ashton Dorkins describes the results of testing more than eight million trades from January 1, 1995, to December 31, 2006. The average one week percentage gain or loss for all stocks during the period tested was +0.25%.

After quantifying overbought and oversold conditions (RSI above 98 is overbought; RSI below 2 is oversold), their research showed that stocks with a 2 period RSI below 2 averaged a gain of +0.88% one week later (beating the benchmark average by more than 3:1). Conversely, stocks that were overbought with a 2 day RSI greater than 98 lost money (-0.17%) one week later as well as underperforming the benchmark.

No comments:

Post a Comment